How to complete a GIA to ISA transfer

This information is relevant for you if you use the Wealthtime platform. If you use the Wealthtime Classic platform, please go to the Wealthtime Classic platform version.

How to complete a GIA to ISA transfer (Individual GIA)

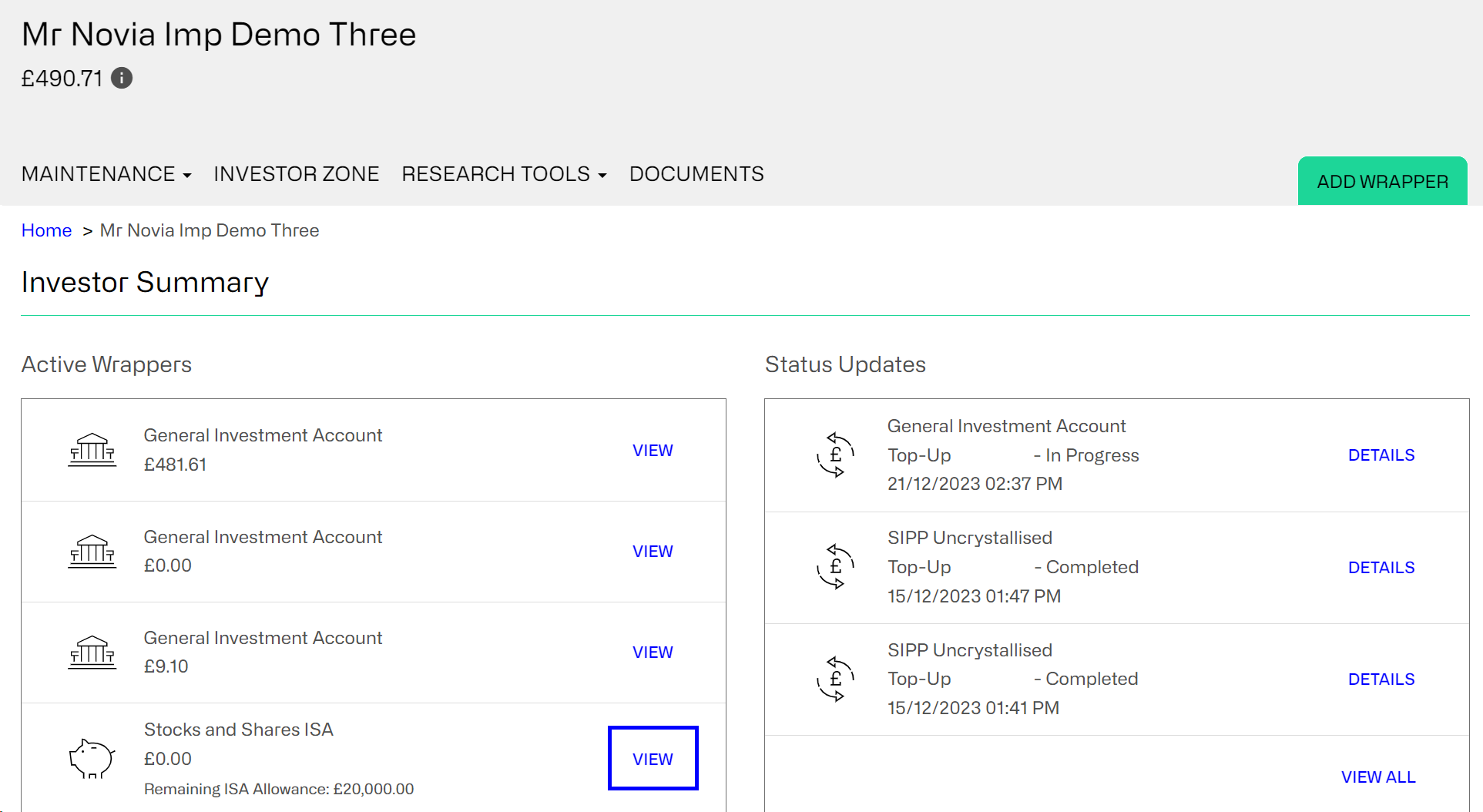

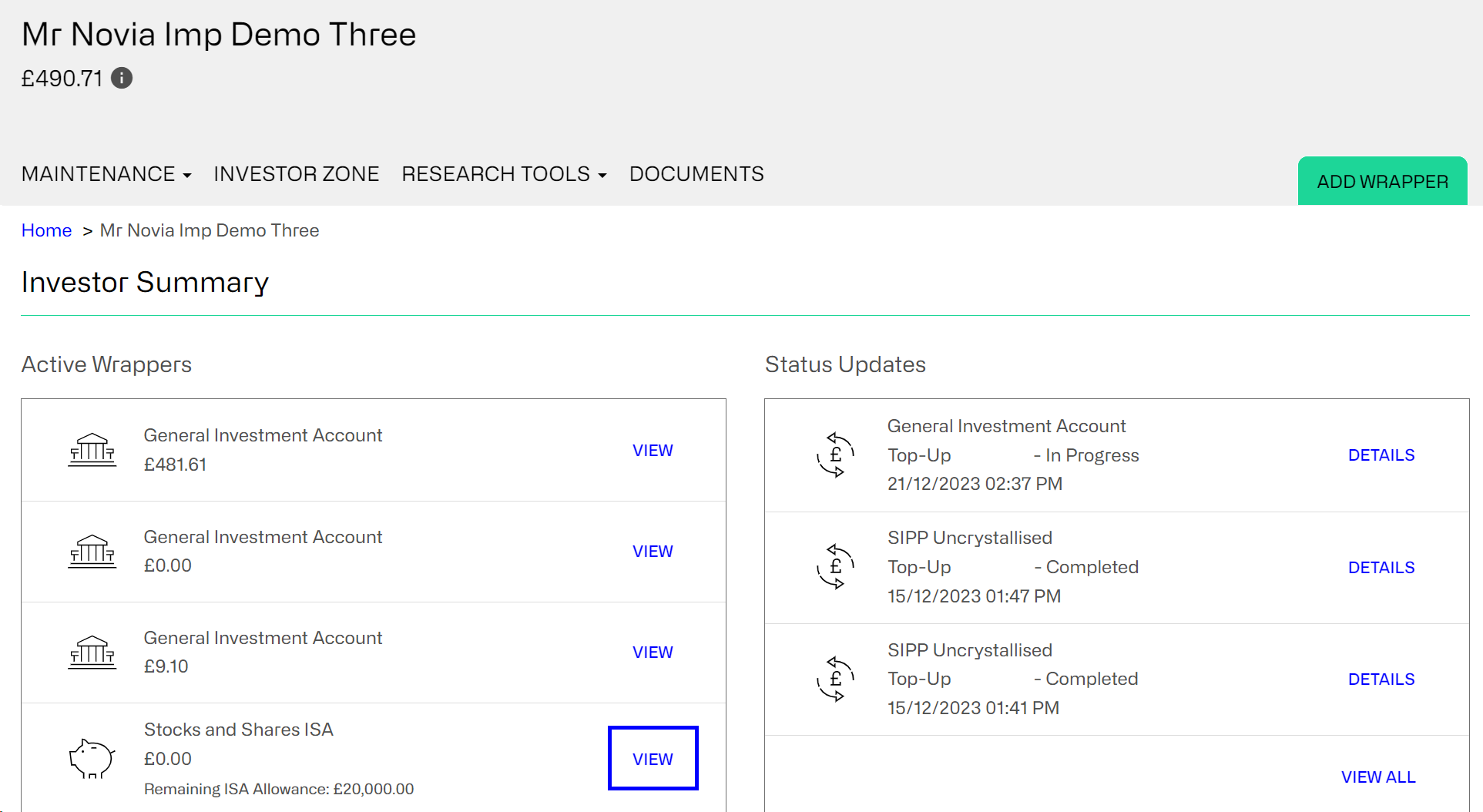

- On the platform homepage, search for your client and press ‘view’ to see their product wrappers

- Classic the client’s ISA and select ‘top-up’

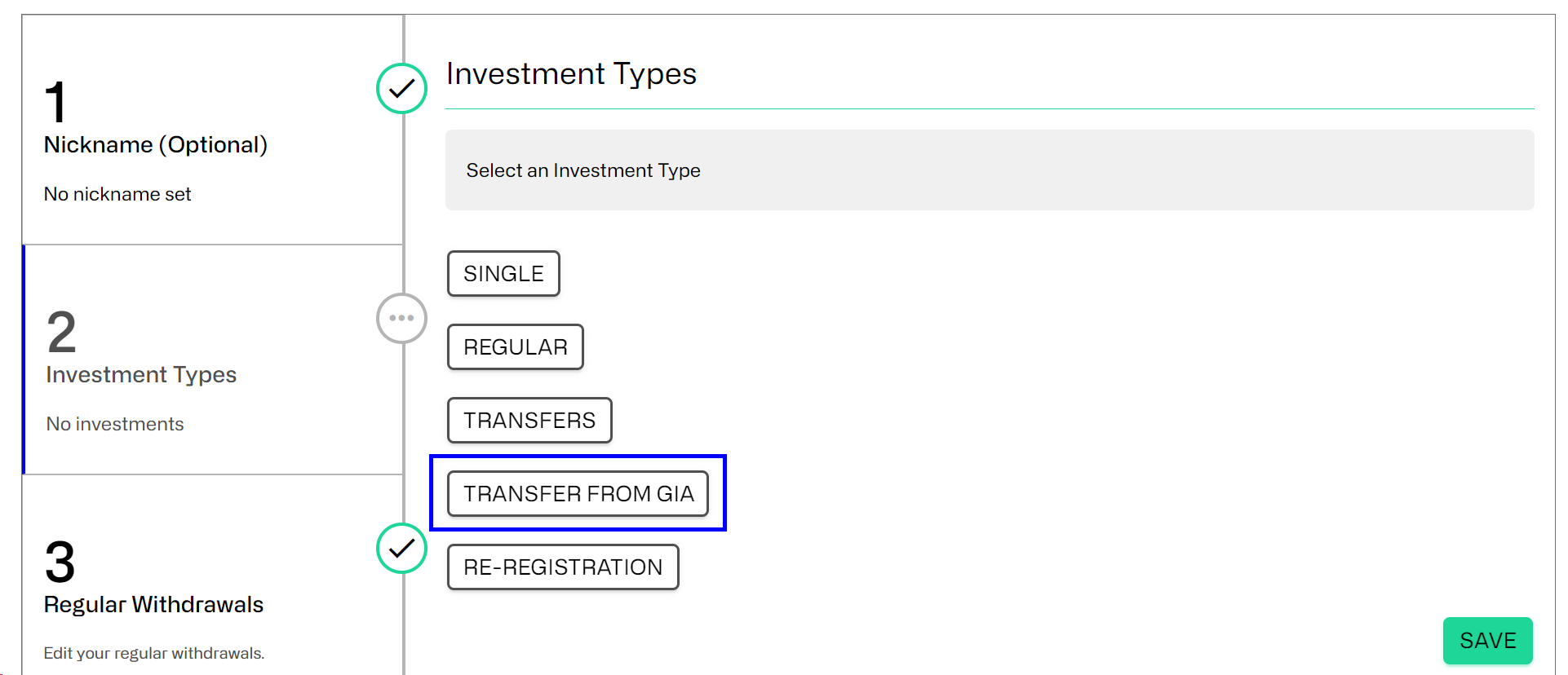

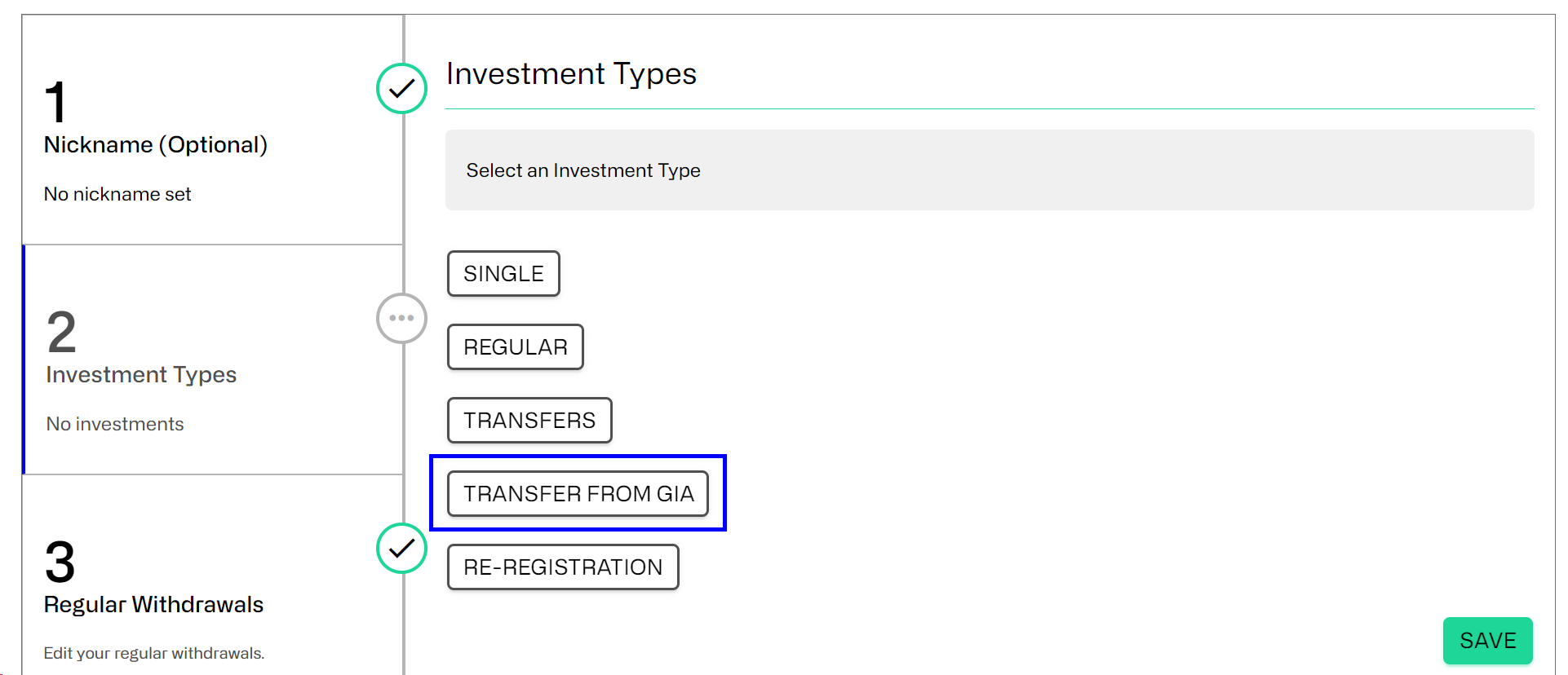

- Under section two, ‘investment types’, select ‘transfer from GIA’

- Classic the GIA you want to transfer from – this will show you the available cash to transfer

- Note: this includes the whole cash balance and doesn’t include our 2% minimum balance or regular withdrawals from the GIA

- Note: If you have recently completed a switch to cash in the GIA and the sale of assets hasn’t completed, this amount will not show in the available cash

- Enter the investment amount

- Note: If there is not enough available cash, you will need to sell down to fund the difference or reduce the transfer amount. The options to sell down will appear automatically. You can choose to use some, all, or none of this available cash and also place a proportionate disinvestment or sale of specific assets.

- Classic an adviser initial charge if applicable

- Note: This initial charge will be deducted from the ISA. If you wish to deduct the charge from the GIA, please submit an ad hoc charge from the GIA wrapper. Go to the GIA, then ‘Maintenance’, then ‘Ad Hoc Charge’. You can then select ‘none’ as the adviser initial charge in the ISA top up.

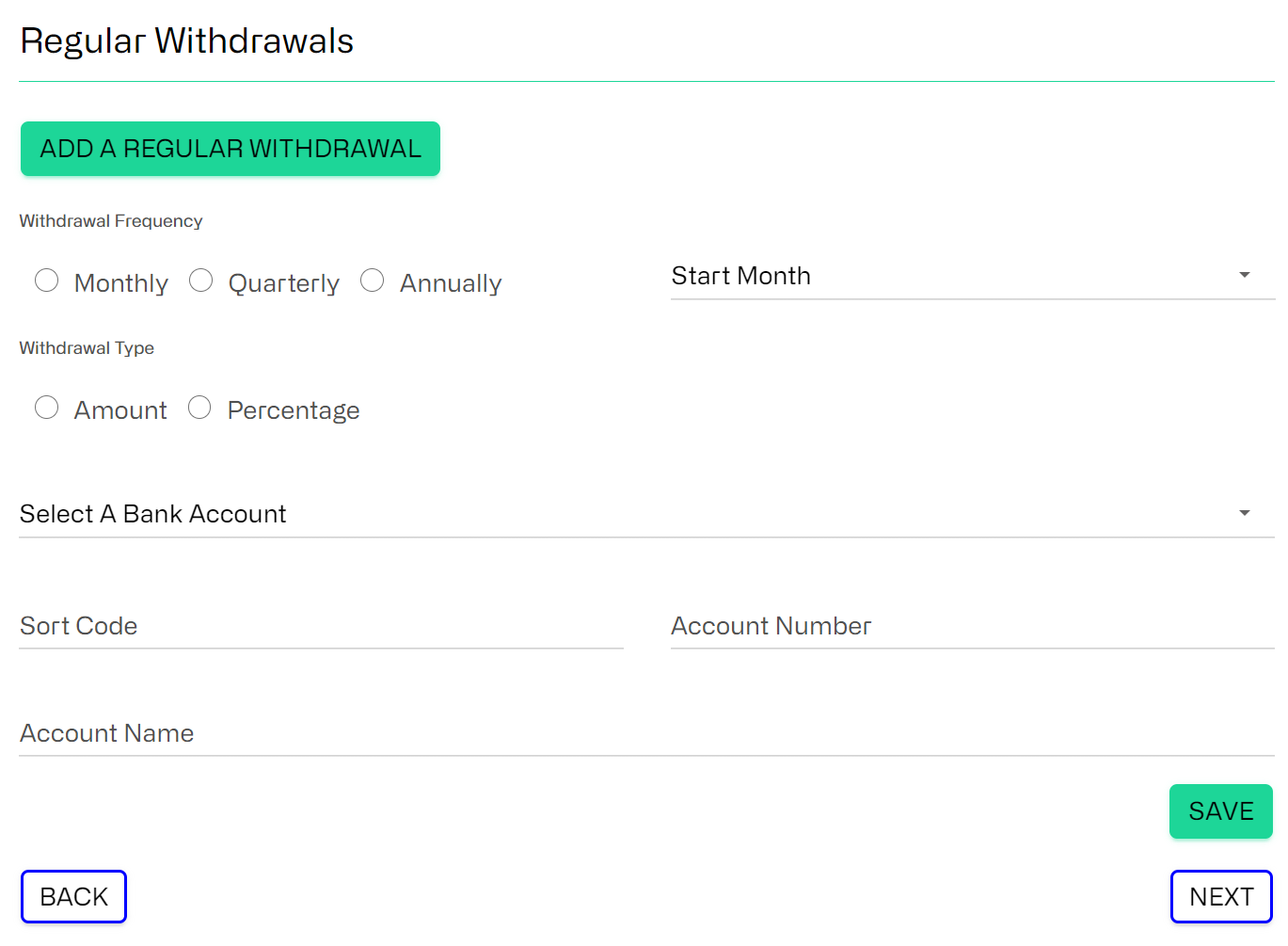

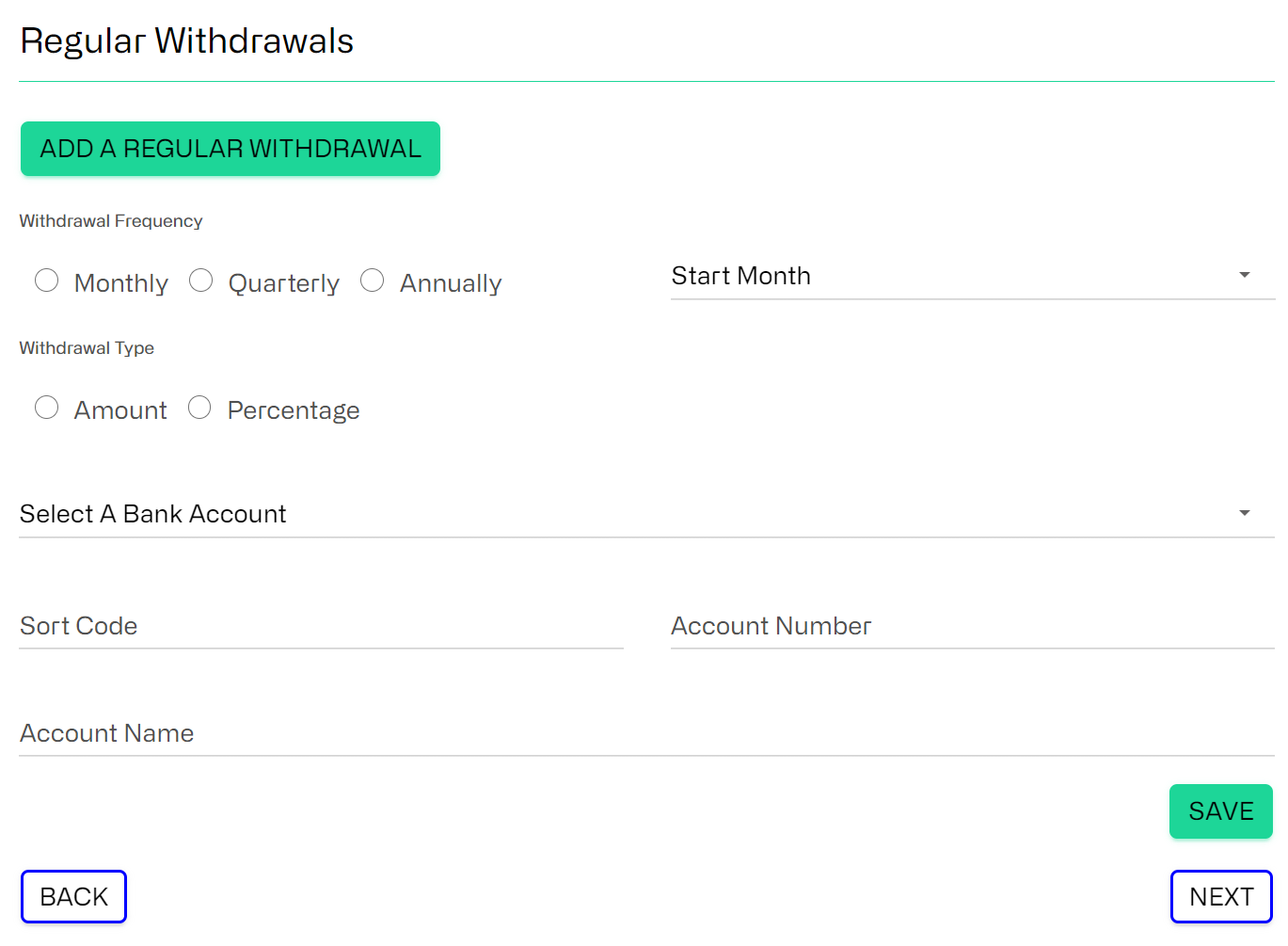

- Classic any regular withdrawals required – you’ll also see confirmation of the ongoing adviser charge

- Classic how the new funds should be invested in the ISA. You can select your default investment strategy or select a different strategy.

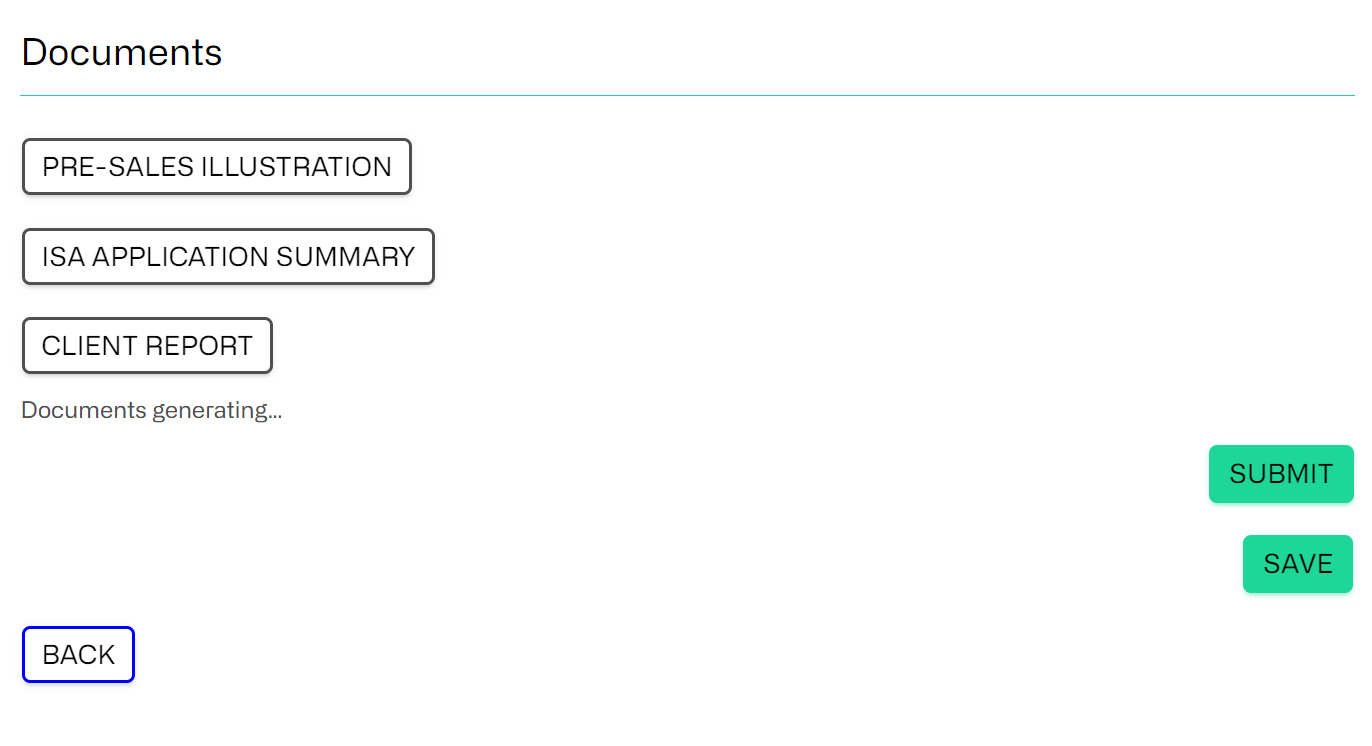

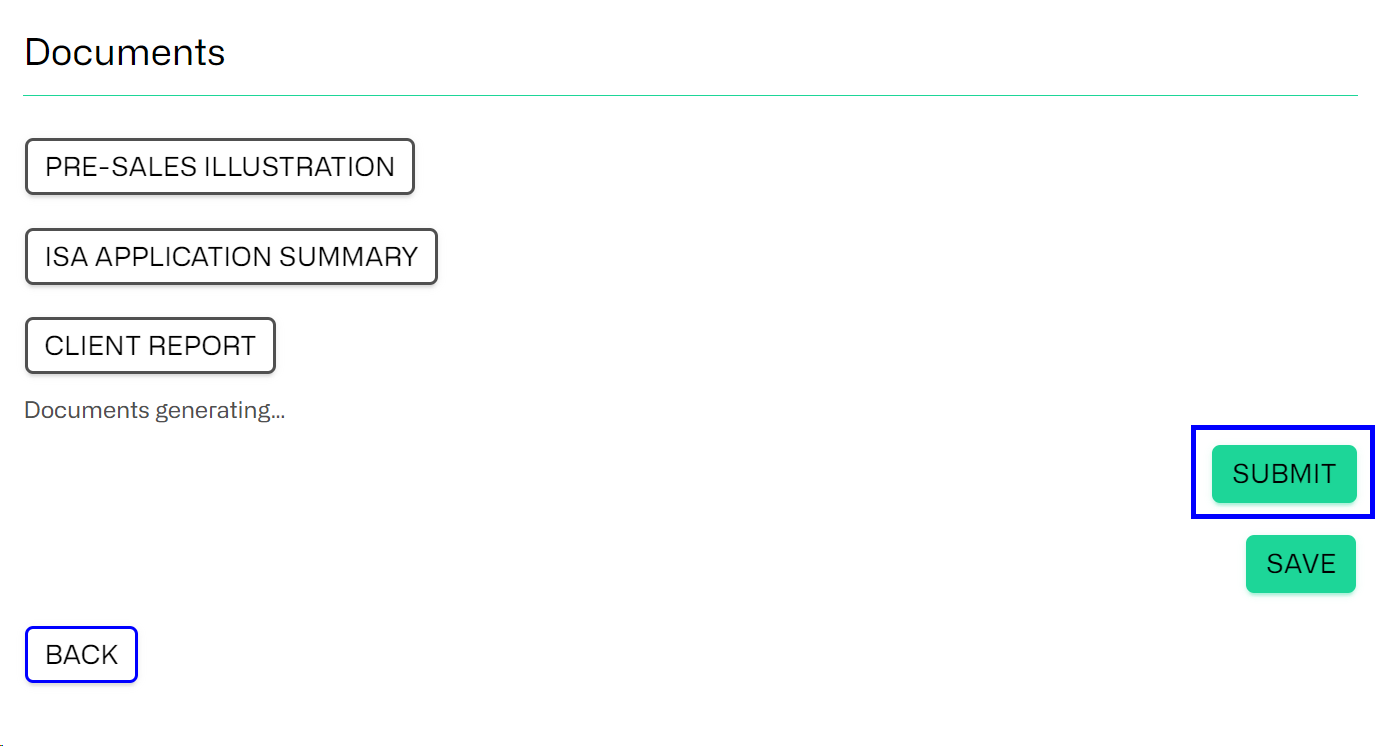

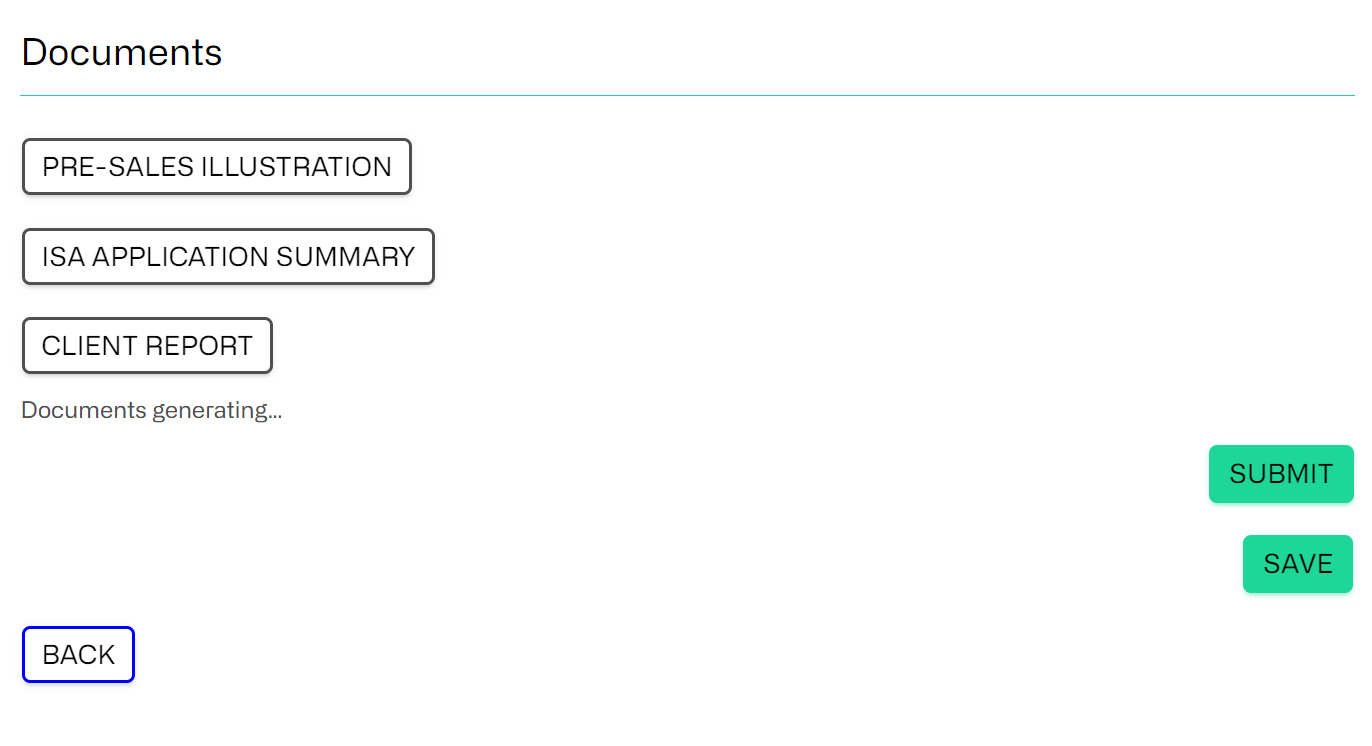

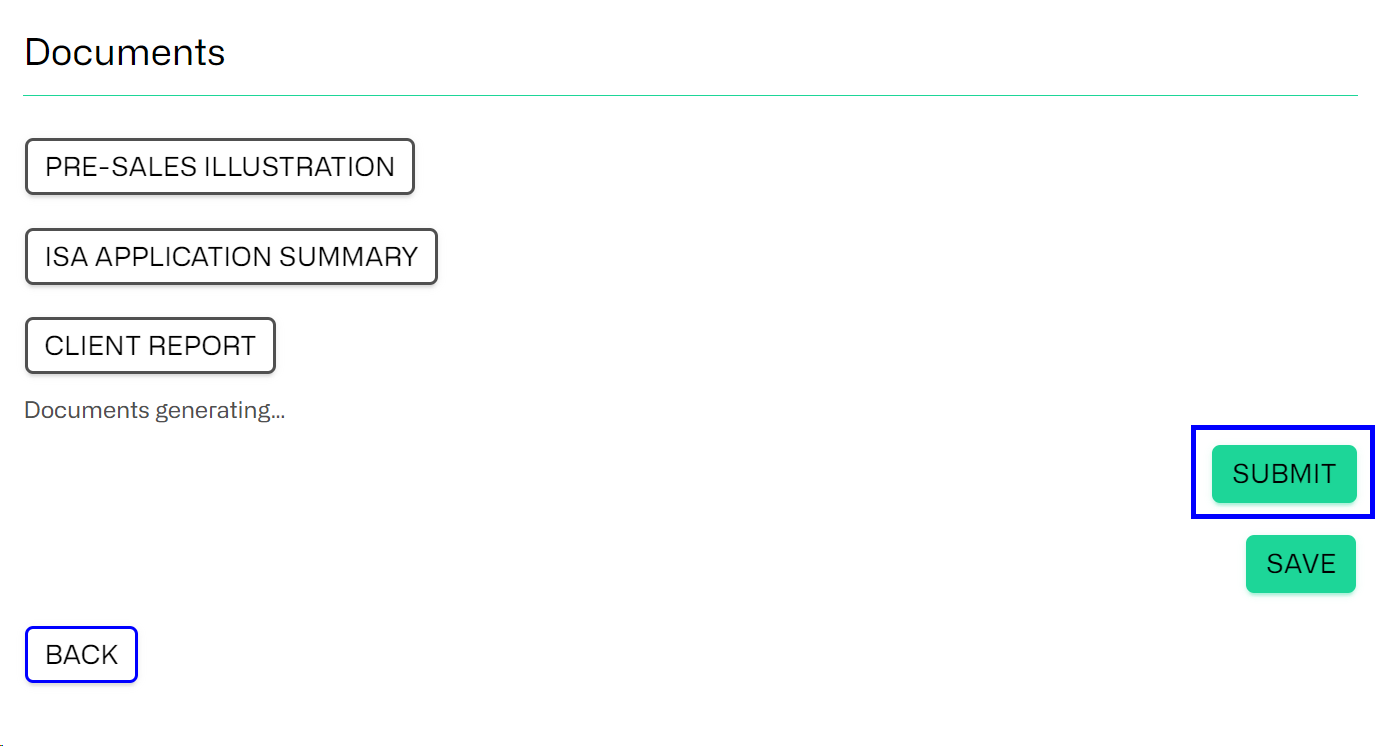

- View and download the documents

- Classic submit to proceed through the terms and conditions

- On submission, trades will be placed (if selected) and upon settlement of all trades, the proceeds will be moved to the ISA and invested as per the instructions in the ISA.

GIA to ISA (From a joint GIA)

- On the platform homepage, search for your client and press ‘view’ to see their product wrappers

- Classic the client’s ISA and select ‘top-up’

- Under section two, ‘investment types’, select ‘transfer from GIA’

- Classic the GIA you want to transfer from – this will show you the available cash to transfer

- Note: this includes the whole cash balance and doesn’t include our 2% minimum balance or regular withdrawals from the GIA

- Note: If you have recently completed a switch to cash in the GIA and the sale of assets hasn’t completed, this amount will not show in the available cash

- Enter the investment amount

- Note: If there is not enough available cash, you will need to sell down to fund the difference or reduce the transfer amount. To sell down, you’ll need to place a sell for withdrawal in the GIA. Go to the GIA, select ‘Switch’, then ‘Sell for withdrawal’. If the GIA will be the source of wealth for multiple ISA’s, please place one sale to cover all Bed and ISAs. This is because once a sale is placed on an asset, you won’t be able to place further sales until the original sale has settled.

- Classic an adviser initial charge if applicable

- Note: This initial charge will be deducted from the ISA. If you wish to deduct the charge from the GIA, please submit an ad hoc charge from the GIA wrapper. Go to the GIA, then ‘Maintenance’, then ‘Ad Hoc Charge’. You can then select ‘none’ as the adviser initial charge in the ISA top up.

- Classic any regular withdrawals required – you’ll also see confirmation of the ongoing adviser charge

- Classic how the new funds should be invested in the ISA. You can select your default investment strategy or select a different strategy.

- View and download the documents

- Classic submit to proceed through the terms and conditions

- Please send a Secure Email requesting that ‘£x amount is moved from wrapper xxxxxx to wrapper yyyyyy and invested as per the instructions in the Top Up.’

- When there is sufficient available cash in the GIA, the cash will be moved to the ISA and invested as per the instructions in the ISA.