03 Jul 2024

Increasing CIP admin burden drives surge in outsourcing

Robert Vaudry, Managing Director of Copia

For professional advisers only

In theory, Centralised Investment Propositions (CIPs) are a great way of managing client money, saving time by standardising the proposition for multiple clients and streamlining a lot of the administration involved. Unfortunately, we’ve found that’s not the case in practice for many advisers.

Two years ago, we published a report with the lang cat, Centralised Investment Propositions: An overheating engine?, looking at how well CIPs were working for firms. Our research revealed that CIPs are becoming a victim of their own success, with the admin burden of managing investments increasing as a firm grows. In 2022, advisers put the number of days spent on average on CIP management at 71, with ongoing monitoring and reporting creating a particular burden, and 97% felt that the requirements of MIFID II and the then looming Consumer Duty would soon make their CIP unworkable.

We’ve now repeated this research, updating and extending our 2022 assessment to see how firms find managing their CIPs in the Consumer Duty world. Our new report, An Overheating CIP: 2024 – Ways to cool the engine, bears out adviser concerns of two years ago. It found that a third (36%) of UK financial advice firms have seen the admin burden of their CIP increase over the last year, with most of the burden carried by those who run their investments in-house.

On average, firms estimate they now spend 81 days annually managing their CIP, an increase of ten days on 2022. Although outsourcing to an external investment manager doesn’t remove the pain entirely, it does reduce it significantly. Those outsourcing spend less than a quarter of the time on CIP operations than those running investments in-house, at 32.5 days and 139 days respectively.

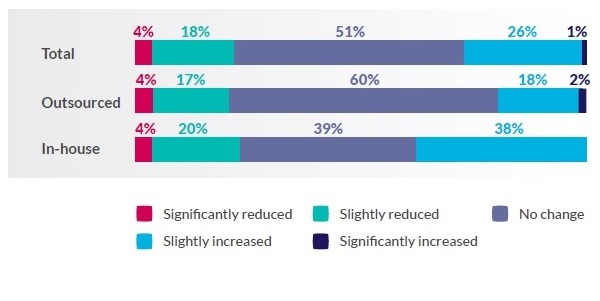

In addition, firms managing their CIP in-house are more pessimistic about the size of the admin burden, with almost two-fifths (38%) expecting it to continue to grow over the next 12 months, compared to a fifth (20%) of outsourcers.

How do you expect the administrative burden to change in the next year?

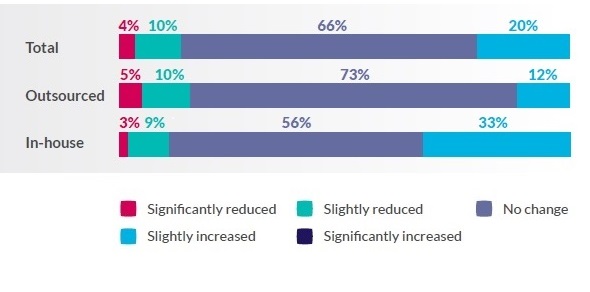

The same is also true for ongoing risk management, with a third (33%) of firms managing investments in-house thinking it will increase in the next year, compared to just 12% of those outsourcing.

How do you expect ongoing risk management to change in the next year?

The new research supports our 2022 finding that CIPs cannot scale indefinitely. The number of portfolios held adds to the complexity, while reporting and monitoring requirements increase incrementally as more clients are added. This is especially a problem for firms who are running portfolios under advisory permissions: with the need to obtain client approval for any portfolio changes or rebalancing.

Firms are now left with a stark choice as they scale. Increasing admin creates a tipping point where, to continue to manage their CIP effectively, growing firms need to invest more in their internal resources. They do this by recruiting investment and operational specialists, using technology wherever possible and potentially taking on their own discretionary permissions. Alternatively, they will need to outsource to an external investment manager.

Our research reveals that increasingly firms are choosing the latter path, with more than half (55%) now outsourcing, and just 34% running their own model portfolios in-house as the primary element of their investment proposition. This is a reversal of our findings two years ago when 51% of firms were managing investments in-house and 38% were outsourcing.

With the FCA’s continued focus on Consumer Duty, fair value and ongoing services, we expect this decision on how to manage a CIP to become even more important. Doing nothing and maintaining the CIP status quo is unlikely to be a viable path to good client outcomes. Hopefully, our report, which is free to download from our website, provides some food for thought on both sides of the debate. And if you’re considering outsourcing, it goes without saying that we’d be delighted to show you how we can help you deliver great outcomes for your clients.

Please remember that the value of investments and the income from them can fall as well as rise, and you may get back less than you invest. Tax treatment depends on individual circumstances and may be subject to change in the future.