03 Apr 2025

Spring Statement – a summary for financial planners

For professional advisers only

It was well trailed ahead of the Chancellor’s Spring Statement that it would not be a “full fiscal event” and so would not contain any tax changes. The Chancellor had made it clear (and has re-iterated since) that there would be one Budget (full fiscal event) in a year – in the Autumn. She was true to her word.

With the help of our friends at Technical Connection, here is our summary of the key aspects of the Chancellor’s Spring Statement.

The economic background

The Chancellor presented her first Budget on 30 October, six days before the US presidential election. The world has changed considerably since that pre-Halloween day – as she has regularly remarked. Thanks largely to the result of that stateside election, the global economic outlook is unclear, whether the view ahead is measured in weeks, months, years or even hours.

Last October’s Budget was the first to be judged under the new set of fiscal rules introduced by Rachel Reeves and designed to give her more scope to borrow for public sector investment. The new rules, which were legislated for in January 2025, are currently:

The so-called ‘Stability Rule’

To have the current budget at least in balance in 2029/30 i.e. tax and other revenue should be equal to, or more than, day-to-day government expenditure. Borrowing would only be for capital expenditure.

The latest projection from the Office for Budget Responsibility (OBR), in its new Economic and Fiscal Outlook (EFO) puts the current budget for 2024/25 £60.7bn in the red, £5.2bn up on its October 2024 projection.

The so-called ‘Investment Rule’

For Public Sector Net Financial Liabilities (PSNFL) to be falling as a percentage of GDP by 2029/30. This replaced the requirement for Public Sector Net Debt ex Bank of England (PSND ex BoE) to be declining as a percentage of GDP on the same five-year timescale. The OBR estimates that PSNFL for 2024/25 will be 81.9% of GDP, 0.9% higher than for 2023/24, but 0.2% of GDP below the OBR’s October projection.

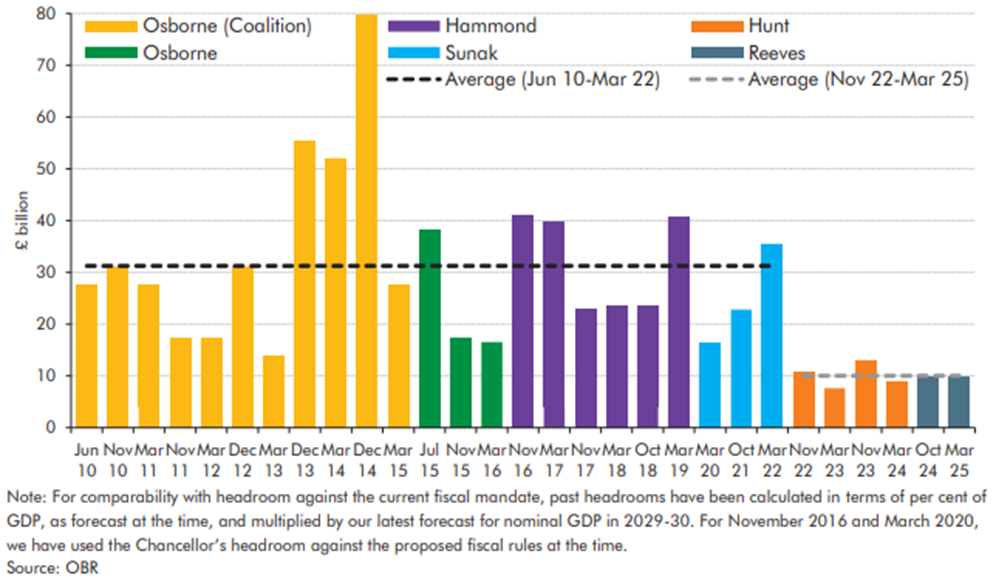

The Chancellor’s primary target is that ‘stability rule’ and it is this on which all the debate about her available ‘headroom’ – or lack of it – has been focused. At the time of the October Budget, the OBR projected in the EFO that the target would be met with a margin of £9.9bn. However, at the time the OBR noted that Reeves’ headroom was “…the third lowest of 28 forecasts since the OBR was established in 2010…[and]… around one-third of the average headroom Chancellors have set aside against their fiscal targets over this period”. The OBR estimated that the chances that the current budget would be in surplus by 2029/30 were 54%.

Source: Investing.com

The OBR’s EFO projections are based on a wide variety of assumptions and there have been some important changes between the October 2024 EFO and the March 2025 EFO.

As a flavour:

| Assumption | October 2024 | March 2025 |

| GDP Growth 2025 | 2.0% | 1.0% |

| GDP Growth 2026 | 1.8% | 1.9% |

| CPI Inflation 2025 | 2.6% | 3.2% |

| CPI Inflation 2026 | 2.3% | 2.1% |

| LFS Unemployment 2025 | 4.1% | 4.5% |

| LFS Unemployment 2026 | 4.0% | 4.3% |

| Bank Rate 2025/26 | 3.9% | 4.0% |

| Bank Rate 2026/27 | 3.6% | 3.8% |

| Weighted average gilt yield 2025/26 | 4.1% | 4.5% |

| Weighted average gilt yield 2026/27 | 4.3% | 4.7% |

Most of these have changed in an unfavourable direction. However, the OBR has accepted that the planning reform will give a boost to growth and for the three years from 2027 assumed that GDP will grow by 0.2% a year faster than it did in October. The OBR thus remains more optimistic about growth than the Bank of England and virtually all independent forecasters.

Without the measures announced in the Spring Statement, the OBR calculated that Reeves’ headroom would have flipped from a £9.9bn current budget surplus in 2029/30 to a £4.1bn deficit. However, the Chancellor has recovered that £14bn by the measures revealed in her Statement. The bottom line is that once again she has £9.9bn of headroom going into the Autumn Budget 2025. Also, for a second time, the OBR has also calculated that there is just a 54% chance that the current budget will be in surplus by 2029/30. It also notes that ‘…a significant increase in headroom would be needed to materially increase the probability that a fiscal mandate will be met, given the inherent uncertainty in any economic and fiscal forecast.”

Successive forecasts for headroom against fiscal targets

Measures and announcements

In her speech, the Chancellor said, “As I promised in the autumn, this Statement does not contain any further tax increases” However, with a £14bn 2029/30 gap to fill, that meant a variety of other financial measures, many of which had been the subject of intense pitch-rolling in the last fortnights. These included:

Government running costs

The October 2024 Budget envisaged annual real growth in day-to-day government spending for 2025/26-2029/30 of 1.3% a year. This will now be cut to 1.2%, with the consequences due to emerge in the Spending Review published on 11 June. Given the protections provided to some departments’ spending, such as health and defence, there could be real terms reductions in unprotected departments.

All departments will be expected to reduce their administrative budgets by 15% by the 2030 which, if achieved, is projected to yield £2.2 billion a year.

Welfare

Cuts to welfare worth £5bn were trailed by Liz Kendall last week, but no impact assessment was produced at the time. We now know why. First, the OBR has scored the initial proposals as only producing savings of £3.4bn by 2029/30. Secondly, the impact assessment revealed that there would be an additional 250,000 people (including 50,000 children) in relative poverty after housing costs in 2029/30. The measures are:

- Personal Independence Payment (PIP) – For new claimants from November 2026 and existing claimants at their first award review after November 2026, the rules for qualification will be tightened. Claimants will have to score a minimum of four points in at least one of eight activities to receive a daily living award. The present qualification level is a total score of eight points across all activitiesWork Capability Assessment – Reforms to the Work Capability Assessment (WCA) announced by the last government and set to start in 2025 have been dropped. From April 2026 WCA reassessments will be resumed.

- Universal Credit Health Element (UHCE)- From 2026/27 new claimants will receive a lower UCHE payment of £50 a week. This will be frozen until 2029/30, as will payments for existing claimants from 2026/27.

- Universal Credit Standard Allowance – As a partial compensation for the PIP and UCHE cuts, the Standard Allowance for Universal Credit will be raised at an above-inflation rate for both new and existing claimants, eventually reaching CPI + 5% by April 2029.

Taxation

Fiscal event or not, few Chancellors can resist the temptation to announce clampdowns on tax avoidance, evasion or non-payment. Rachel Reeves proved no exception.

- Collection of tax debts – HMRC will increase its use of third-party debt collection agencies to gather unpaid tax. It will also recruit 500 additional compliance staff, and 600 more debt management staff.

- Late Payment Penalties – Late payment penalties for income tax Self-Assessment (ITSA) taxpayers will increase as they join Making Tax Digital (MTD) from April 2025 onwards. The new rates, which will also apply to overdue VAT, will be:

- 3% of the tax outstanding where tax is overdue by 15 days; and

- 3% where tax is overdue by 30 days; and

- 10% per annum where tax is overdue by 31 days or more.

- Making Tax Digital for Income Tax Self-Assessment – The current threshold for Making Tax Digital for income tax Self-Assessment (MTD for ITSA) will be £30,000 from April 2026. From April 2028, the threshold will be cut by £10,000, meaning it will apply to taxpayers with trading or property income over £20,000.

- High Income Child Benefit Charge (HICBC)- Claimants of Child Benefit (or their partners) who are newly liable for HICBC will be able to pay the tax charge through Pay As You Earn (PAYE) without having to submit a Self-Assessment (SA) tax return, as is currently a requirement. The start date for this is set as “summer 2025”, with no indication when – or if – it will be extended to existing claimants.

- Tax Consultations -There was a relatively small forest of consultations published, many of which had been foreshadowed last October. The areas covered include reform of HMRC penalties for inaccuracy and failure to notify, Advance Tax Certainty for Major Projects and advance clearances for R&D reliefs. Two of these consultations focus on tax advice:

Enhancing HMRC’s ability to tackle tax advisers facilitating non-compliance

This consultation examines options to enhance HMRC powers and sanctions to take swifter and stronger action against professional tax advisers who facilitate non-compliance in their client’s tax affairs. It proposes a suite of potential measures to more effectively review and sanction professional tax advisers whose actions contribute to the tax gap or otherwise harms the tax system. The proposals apply to tax advisers regardless of whether they are members of professional bodies, or how they define their activities. This means that professions such as solicitors, auditors and financial advisers are in scope of the proposals for any work they do which amounts to tax advice or services.

Closing in on promoters of tax avoidance

This consultation is seeking views on proposals in four areas:

- Expanding the scope of the Disclosure of Tax Avoidance Schemes (DOTAS) regime This would include at a new hallmark to more clearly target disguised remuneration schemes; a criminal offence for failure to notify arrangements under DOTAS and updating the DOTAS civil penalty regime.

- Introducing a Universal Stop Notice and Promoter Action Notice.

- Tackling controlling minds and those behind the promotion of avoidance schemes through new highly targeted obligations and stronger information powers,

- Expanding action against legal professionals designing or contributing to the promotion of avoidance schemes.

In addition, the consultation flags several areas the government intends to explore further in the future.

ISAs

Hidden in the main Spring Statement document, with no other supporting material, was a paragraph that said, “The government is looking at options for reforms to Individual Savings Accounts that get the balance right between cash and equities to earn better returns for savers, boost the culture of retail investment, and support the growth mission.” While dressed up as helping savers, in reality this is a measure to bolster government finances. A recent Freedom of Information request from A J Bell revealed that tax relief on cash ISAs cost the Treasury an estimated £2.1bn in 2023/24.

Fees for Home Office services

From April 2025 there will be fee increases for many documents supplied by the Home Office. For example, fees for Electronic Travel Authorisation (ETA) will rise from £10 to £16 and passport fees will rise by 7%.

The Autumn Budget

A cynic might note that by reclaiming fiscal headroom of £9.9bn, the Chancellor has left herself with a sum that did not even survive for the five months from the date of her last Budget. She now must hope that the same amount will not disappear in the next seven or eight months. In the meantime, there is the risk that the spectre of further tax increases will subdue the economic growth which is the government’s ultimate get-out-of-jail card.

The period to the next Budget is a long time in the disruptive world of Donald J Trump. While he went unmentioned by Rachel Reeves in her speech, it is noteworthy that the OBR modelled three different US trade tariff scenarios under its ‘Recognising Uncertainty’ section covering fiscal targets. As if to corroborate this caution, overnight they said ‘Donald’ announced a “100% permanent” tariff of 25% on all imports to the USA of motor vehicles and their components, to take effect in seven days’ time.

So what?

Wednesday 2 April, a week after the Spring Statement, is Trump’s ‘Liberation Day’, when he is due to reveal his ‘reciprocal’ tariffs. Even if the UK dodges that bullet – possibly at the cost of ending the Digital Services Tax (a move which it currently seems that the Chancellor will resist) – its economy could still suffer from the tariffs’ impact on global growth.

Talk (and expectation) of some form of tax rises in the Autumn Budget has already begun in the media and this is likely to continue in the period leading up to the next ‘big day’. Tax is thus set to remain very firmly on the financial agenda for many which means that the need for informed advice on how to deliver tax efficiency at all stages of the wealth journey will remain high.

Given this inevitability, starting the new tax year with a personal tax health check or personal tax audit could represent an excellent way to engage with existing or new clients. The combination of the recently introduced and forthcoming tax increases, reduction in allowances and exemptions and continued freezing of tax thresholds together with concern over the future of taxation result in there being an important opportunity and responsibility to ensure that your clients start and continue through the forthcoming tax year in the best possible tax health.

This summary is provided strictly for general consideration only. No action must be taken or refrained from based on this summary alone. Advice is absolutely required in each case. Accordingly, neither Wealthtime, Technical Connection nor any of their respective officers or employees can accept any responsibility for any loss occasioned because of such action or inaction. Tax treatment depends on individual circumstances and may be subject to change in the future.

Call our team today

Whether you're looking to start using our service, or simply have a question for us, we're just a phone call or email away. Lines are open 9am to 5pm Monday to Friday. To help us improve our service, we may record or monitor calls.For Wealthtime platform queries, call

0345 680 8000

For Wealthtime Classic platform queries, call

03330 417 010