Use of Centralised Retirement Propositions almost doubles following thematic review, finds Wealthtime and Copia

Research by Wealthtime and Copia Capital reveals an increasing number of financial advisers are changing their retirement propositions following the FCA’s focus on retirement income advice.

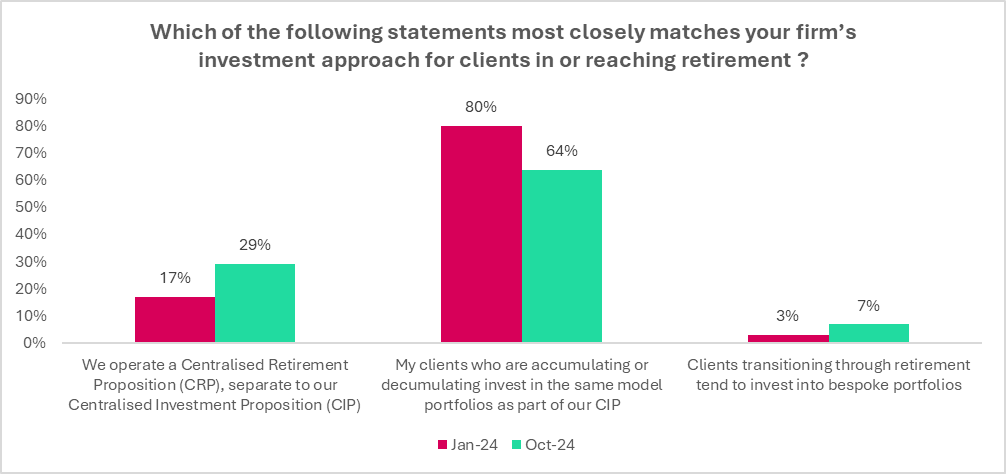

A survey of financial advisers in January as part of Wealthtime and Copia’s Rethinking Retirement: Changing Gear? report before the publication of the thematic review, revealed that just 17% of respondents operated a Centralised Retirement Proposition (CRP) separate from their Centralised Investment Proposition (CIP), while 80% used the same model portfolios for clients in accumulation and decumulation and 3% used bespoke portfolios for those transitioning through retirement. A follow-up poll during the companies’ Rethinking Retirement Roadshows last month, found that 29% of respondents now have a specific CRP and 7% use bespoke portfolios for those in retirement, while the number using the same CIP for clients accumulating and decumulating has dropped to 64%.

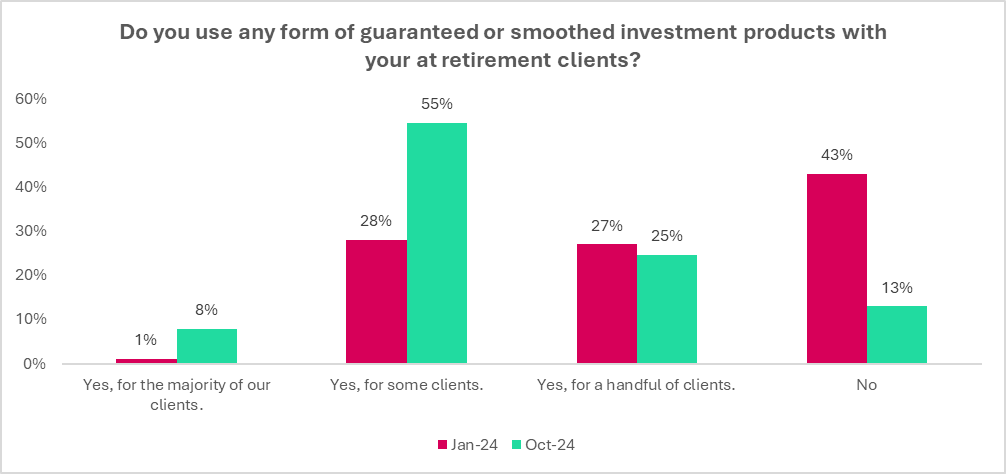

The research also revealed a significant change in the use of guaranteed investment products for clients in retirement. The January survey found that 56% used these products for at least some clients, but by October this had increased to 88%.

Tony Hicks, Head of Sales at Copia Capital, comments, “The impact of the FCA’s thematic review of retirement income advice continues to be felt as firms increasingly realise that their retirement propositions might not be as robust as they previously thought. Ensuring that they are meeting the regulator’s standards is particularly important given the Dear CEO letter to financial advisers last month which reinforced the FCA’s expectations for good practice and its ongoing focus on this area.

“Pension freedoms unlocked greater flexibility around retirement planning for many people, but in doing so, created more complexity in mitigating the specific risks faced in decumulation to deliver a sustainable income throughout retirement. It is encouraging that firms are continuing to review their advice processes to protect clients from foreseeable harm. Providers have an important role to play too, with further innovation around investment solutions and retirement functionality that meets the needs of those in decumulation and helps support good outcomes for clients.”

-ENDS-

Notes to Editors:

About the research

The original research formed part of Wealthtime and Copia’s Rethinking Retirement: Changing Gear? Report. It was conducted among 160 advice professionals in January 2024 via the lang cat’s Adviser Research Panel. The follow-up research took place was conducted during the Wealthtime and Copia Capital Retirement Roadshows in October 2024 with 88 respondents. Due to rounding, total figures may not add to 100%.

Press contact

Jenette Greenwood, PR Director, the lang cat

07710 392303 / jenette@langcatfinancial.com

About the Wealthtime Group

Private equity firm AnaCap Financial Partners owns Wealthtime, Wealthtime Select, and Copia Capital. Patrick Mill is CEO of all three businesses in the Group.

Combined, the platforms have over £11.3bn of pension and investment assets under administration (AUA) and over 76,000 clients (as of Jan 2024). AUA is split £8.85bn and £2.45bn, Wealthtime and Wealthtime Select respectively.

Copia Capital, the discretionary fund management (DFM) part of the Group is a pure B2B DFM that works exclusively with advisers to provide a range of managed portfolio services. These include its MPS Custom service, offering customised portfolios to advisers which are constructed to meet the adviser’s retail clients’ needs; its ‘ready to go’ MPS portfolio products; and the added-value MPS Plus range.